Table of Content

- Do HomeReady and Home Possible have any special rules after closing?

- Mortgage income requirements in 2022

- The Latest Boost For Affordable Housing: Gse Loan Limits Now Above $1 Million

- Are There Freddie Mac Programs For Low

- Home Possible Income Requirements

- State Income Tax In Nevada

- What are home possible loans?

- Eligibility Requirements for Home Ready & Home Possible Loans

Household income for eligible buyers may not exceed eighty percent of the area median income, which mortgage applicants can verify at the Freddie Mac website. The requirements for qualifying for each program are also different. This includes factors like credit score, income, and debt-to-income ratio. Some borrowers may find it easier to qualify for one over the other.

This might be an option if you have very little equity in the home. You can also refinance out of a Home Possible loan into a different loan program, provided you qualify. These programs are typically limited by putting income restrictions on you. This restriction comes in the form of a maximum income to be eligible for the discounted mortgage. Even the regular limit of $726,000 is well above $455,000, the median sale price for homes in the United States. No, you do not have to be a first-time purchaser to qualify for a Home Possible loan.

Do HomeReady and Home Possible have any special rules after closing?

Most geographic areas of the United States will have loan limits of $726,000 in 2023, up from $647,200 in 2022. FNMA and Freddie Mac will, for the first time, be able to purchase home mortgages that exceed $1 million. No, you cannot take cash out with a Home Possible refinance loan. According to Freddie Macs requirements, youll need a FICO score of 660 or higher to qualify for a Home Possible loan. This is more flexible than other conventional programs which require no more than a 50% DTI ratio. Qualifying for either program depends on a wide range of factors, and can vary based on geographic locations and other issues.

It really is essential to talk to a lender to find out all the first-time home buyer loan options you can qualify for. Getting pre-approval on a loan is a great first step toward buying a home. It may feel overwhelming, but that’s when using a trusted mortgage lender like Mares Mortgage can really help. The first thing you will want to do is apply for a mortgage pre-approval. To apply, talk to your lender, and they will assess how much they will lend you based on your income, credit score, and assets.

Mortgage income requirements in 2022

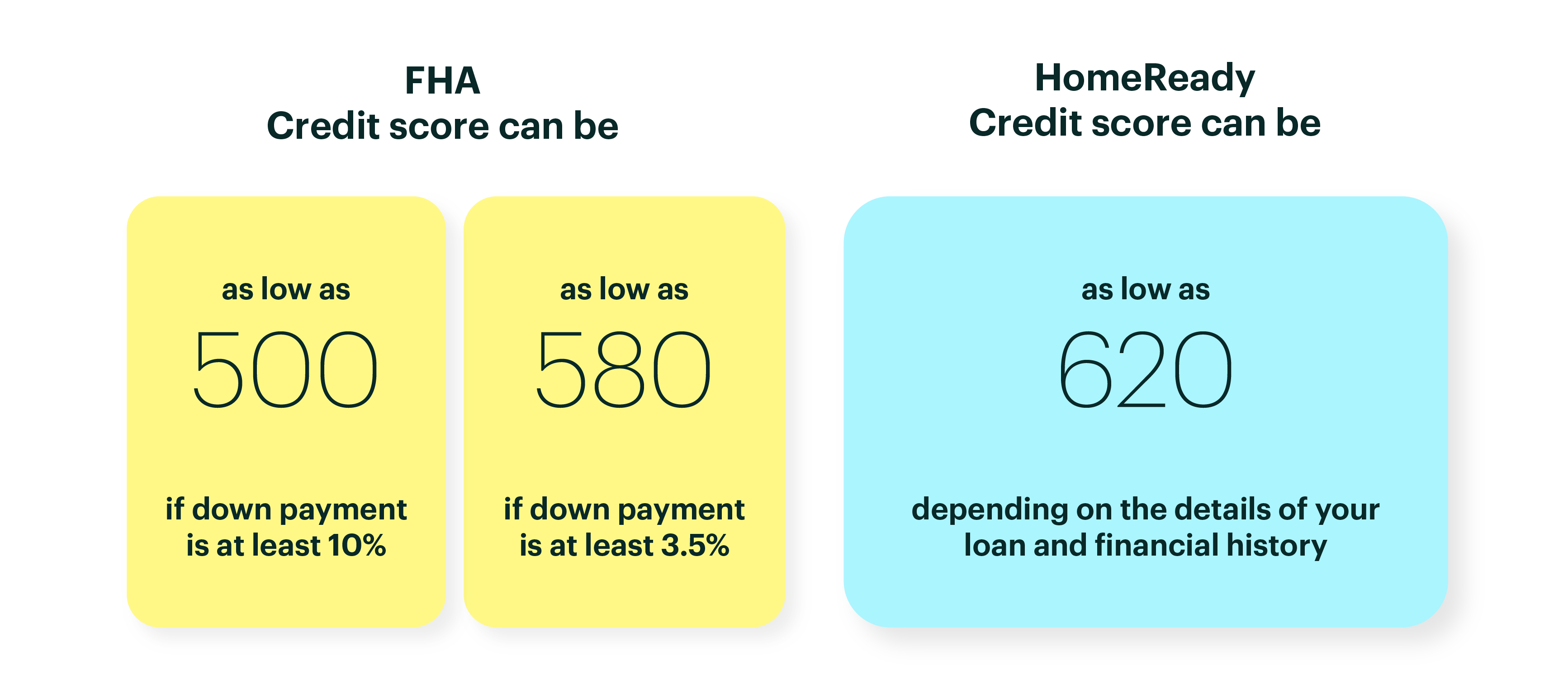

For FHA loans, the front-end DTI ratio max is 31%, while the back-end DTI ratio is capped at 43%. The front-end ratio only considers your mortgage PITI payment . The back-end ratio looks at your mortgage payment, plus all other revolving monthly debt, including car loans, credit card payments and other loans.

Numerous factors determine whether you’ll qualify for a home loan. Your mortgage lender will look closely at your credit history, your debts, cash on hand, and income to gauge affordability. If you’re not sure whether your income qualifies, talk to a mortgage lender. Your loan officer can help you understand which sources of income are eligible and the home prices you can afford based on your monthly cash flow. Thanks to today’s flexible mortgage programs, you don’t need a high salary to buy a home. Low-income mortgage programs can make buying affordable even for families without a lot of cash flow or savings.

The Latest Boost For Affordable Housing: Gse Loan Limits Now Above $1 Million

This can only be used to lower your rate and/or make a term change. All major mortgage investors such as Fannie Mae, Freddie Mac, the FHA and the VA have specific fees that are charged based loan amounts and different risk factors. While this program is specifically funded by Freddie Mac, Fannie Mae’s HomeReady® program is very similar in terms of both qualifications and who it targets. Your lender will be able to help you decide which is right for you.

It offers low down payments, low fees, and low mortgage insurance requirements. It’s not available for vacation homes or investment properties. The good news is that you can purchase up to 4 units, so you can live in one and rent out the others.

Are There Freddie Mac Programs For Low

You can then search for real estate within that price range. A minor decrease from one year to the next is usually okay. Just know that lenders typically average your self-employment income over this two-year period to determine your qualifying amount.

If you’re ready to look into your loan options, you can apply online today. Finally, VA loans are available for eligible veterans, reservists, members of the National Guard, active-duty personnel and qualified surviving spouses. Manual underwriting means someone goes through and evaluates your income and credit history along with the amount of assets you have and the suitability of the property. This is different from automated underwriting which involves computerized decision-making based on your loan application. For some borrowers, the manual underwriting process may be helpful.

For the purposes of these loan options, that means not having a 30-day late payment in the last 6 months and only one in the last year. If you plan to have someone rent a room or part of the property from you, you can also use your future rental income to qualify you for the loan. To do this, the renter cannot be on the mortgage, must have lived with you for at least one year, and cannot be your spouse or domestic partner. Youll also need to provide documentation of paid rent for the last 12 months. Pre-approval is based on a preliminary review of credit information provided to Fairway Independent Mortgage Corporation which has not been reviewed by Underwriting.

You’ll need a two-year history of employment, although VA-guidelines give some flexibility if your employer varies the income is stable and likely to continue in the future. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Use the income eligibility search tool to check on the limits in your state. If you’re buying an energy-efficient home, you may qualify with a debt ratio as high as 45% and a credit score as low as 580. Can prove their creditworthiness with alternative data. For example, lenders may accept 12 months of consecutive, on-time rent payments, along with utility bills and car insurance payments, to prove your history of paying bills on time.

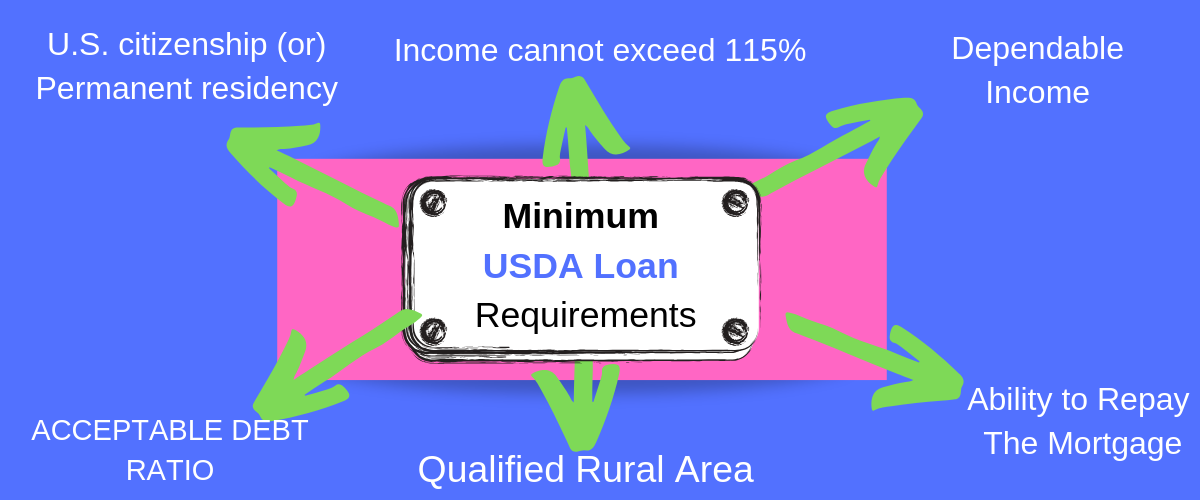

You can also use funds from a secondary source, if applicable. USDA streamlined refinancing is a mortgage-refinancing option for homeowners who bought their home using a USDA loan. Apply online for expert recommendations with real interest rates and payments. Income lookup tool to help potential borrowers figure out if they qualify. Ⓡ, you can finance up to 105% of your home value in total. This is because your down payment can be funded through a second mortgage on it in the Affordable Seconds program where your lender allows it.

Freddie Mac and Fannie Mae have new refinance programs to help low-income borrowers with higher DTIs to refinance and take advantage of lower rates and the opportunity to lower their payment. They’re called Refi PossibleSM and RefiNow™ 1, respectively. Freddie Mac also offers a different loan program called HomeOne. Like Home Possible, it offers loans for as little as 3 percent down.

When researching mortgage options, you’ll quickly realize the down payment requirements on Home Possible mortgages offer a clear advantage. On a typical home loan, buyers would have to hand over at least 20% of the sales price for a down payment in order to avoid any mortgage insurance requirements. Home Possible loans might come with stricter credit requirements than other mortgage assistance programs. If you apply with a credit score of 680 or higher, you can avoid additional lending expenses that come with other mortgage programs. FHA loan qualifications don’t usually require cash reserves unless you’re buying a two- to four-unit home or trying to qualify with a lower credit score. In the past, that meant a loan denial for a conventional loan.

No comments:

Post a Comment